The African Continental Free Trade Area agreement (AfCFTA) will constitute the world’s largest free trade area, consolidating an integrated market of 1.3 billion consumers with a combined gross domestic product (GDP) of approximately $3.4-trillion. The objective is to realise a continent-wide single market for goods and services with free movement of business, persons and investments.

The AfCFTA envisions to expand intra-African trade and intensify regional integration by successively eliminating tariffs on 90% of product categories. Removal of such trade barriers assures to not only improve efficiency, enhance competition, and incentivise development of strategic solutions to local challenges through regional economies of scale, but essentially advance the efficacy of resource allocation.

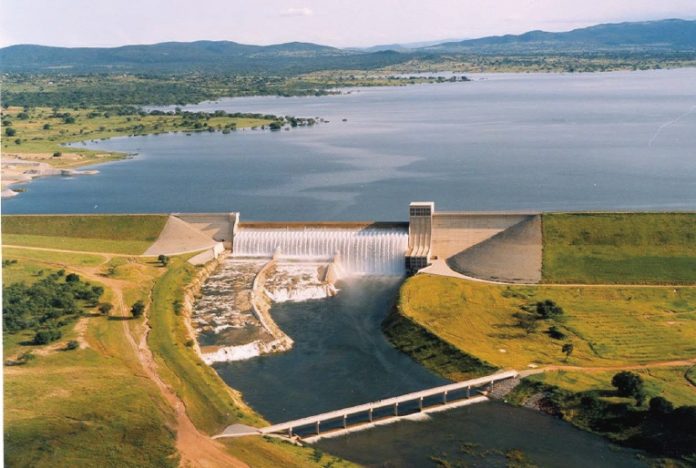

Successful implementation of the agreement is set to have a profound impact on the continent’s energy sector. Regional integration pertaining to energy represents a viable solution for emerging economies, to enhance their energy landscapes in furtherance of realizing social, environmental and economic benefits. Regional integration is pivotal to ensure that energy resources get from localities where they are most affordable, to where they are required.

Regional integration on account of the AfCFTA, is forecast to improve security of supply. Integrating operational reserves and installed capacity enables combined power systems from having to invest in additional facilities. In the event of emergency situations, regional collaboration provides an alternative source of supply for operating reserves and support thereof. Sharing with neighbouring countries can provide advanced system flexibility and reliability by expanding the supply portfolio of diverse energy resources, as opposed to exclusively relying on regional and established resources and supply infrastructure.

To address the continent’s existing energy infrastructure gap, African governments are proactively aiming to expand electricity access, deliver clean cooking solutions and pursue inclusive sustainable energy development.

While these efforts are locally supported through existing platforms such as the regional power pools, the AfCFTA provides an entirely new platform to expand these efforts regionally and pursue energy development to relieve the infrastructure restraint. For instance, one key anticipated outcome of the agreement is the acceleration of industrial output that would comparatively depend on the availability, affordability and security of energy supplies at a scale for industrial growth.

Improved energy trade and energy integration initiatives will boost economic development in Africa by reducing transaction costs and enabling market and economic collaboration, conclusively accelerating investment incentives. Furthermore, removal of impediments to intra-African trade by AfCFTA portends additional US public and private investment in Africa’s oil and power sectors, since increased investment is aligned with US policy as well as sound business consideration.

Africa is renowned for its abundance of renewable energy resources, which include wind, solar, geothermal and hydropower. These constitute a consequential impetus for regional energy integration. Progression and mobilisation of such clean renewable energy sources through regional collaboration efforts afford the continent’s citizens improved environmental quality. “Developing renewable energy resources to address the demand for energy in Africa, will be in the spotlight at the upcoming Africa Energy Indaba. The conference will discuss the AfCFTA and how investors and energy project developers can benefit from the agreement and how this can catalyse the development of renewable energy projects,” commented Liz Hart, Managing Director, Africa Energy Indaba.

The 2020 Africa Energy Indaba is set to assemble leaders from the regional and international power and energy community to discuss the status of critical projects, identify lucrative investment and development opportunities, how best to capitalise on those prospects, as well as to share industry best practice.

The 12th annual event will be hosted 3 – 4 March 2020 at the Cape Town International Convention Centre, South Africa.

Register to attend